ADVANTAGES

of using

a surety bond

- An alternative to the letter of guarantee issued by bank

- Effective management of company’s financial resources and cash flow

- Reduction of costs generated by the policy underwriting

- Rapidity in assessing the financial analysis of the applicant company and in underwriting the surety bond

- Flexibility in negotiating the costs incurred by the issuance of the counter-guarantees, depending on the creditworthiness of the applicant company or/and of its group

- Possibility to use the surety bonds in Romania and in the UE countries in which the insurer is authorized

- Increase in the company’s capacity to take part in a bigger number of public tender procedures in the same time

AUTHORIZATIONS

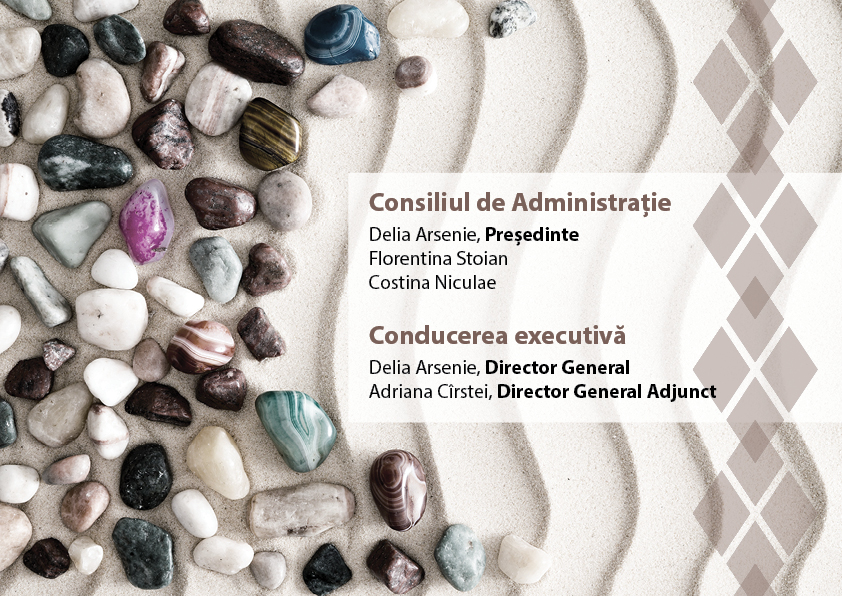

ONIX ASIGURĂRI S.A. was authorized by the Financial Supervisory Authority (FSA) under number RA-031/10.04.2003

The general insurance classes for which the company is authorised:

| A.1. |

Accidents, including industrial injury and occupational diseases |

| A.3. |

Land vehicles, other than railway rolling stock |

| A.7. |

Goods in transit, irrespective of the form of transport |

| A.8. |

Fire and natural forces, covering all damage or loss of property, other than property included in Classes A3 through A7 |

| A.9. |

Other damage or loss of property other than property included in Classes A3 through A7 |

| A.10. |

Motor vehicle liability, the use of motor vehicles operating on the land, including carrier’s liability |

| A.13. |

General liability, other than those referred to in Classes A10 through A12 |

| A.14. |

Credit |

| A.15. |

Suretyship |

| A.16. |

Miscellaneous financial loss |

| A.18. |

Assistance for persons who get into difficulties while travelling, while away from their home or their habitual residence |

PUBLIC INFORMATION

Download annual reports:

Summary of financial statements

IFRS Financial Report

and Report SFCR